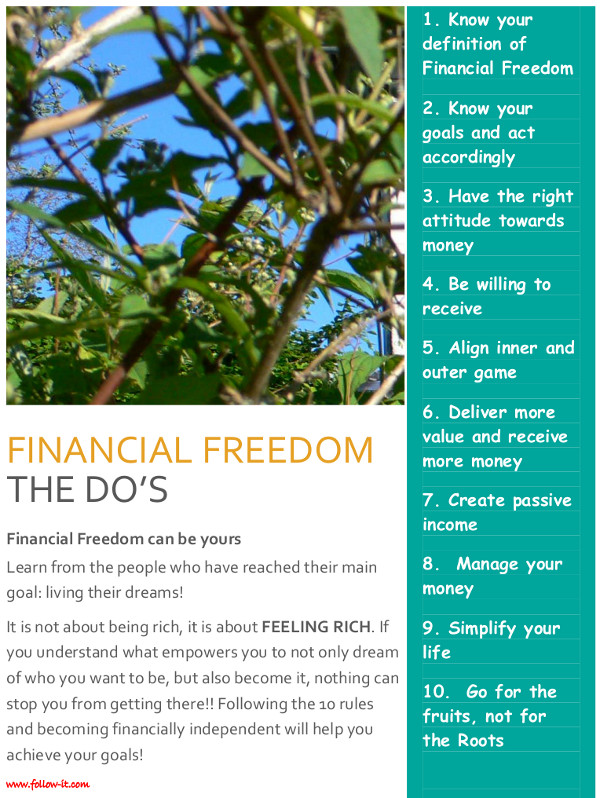

Joining the workshop on Financial Freedom has been an eye-opener to me. I started 4 years ago to work on the goal to become financially independent and I am basically there. These are the “rules” I work with:

Tip 1 Know what your definition of Financial Freedom is

What does Financial Freedom mean to you? What would your life look like if you would be doing the things you like to do, where you would like and with whom you would like?

Be realistic and colour the picture in all the details possible. Be honest as well, if the things that make you happy are within reach and even do not cost money, be brave and reach out. If they are depending on money, calculate exactly how much. Be specific. You have nothing to lose and all to gain.

Tip 2 Know your Goals and act accordingly

If you know what the future picture should look like, you can start to translate this picture into GOALS to be reached. But you should not only know what you want, more importantly is WHY you want this. The bigger the WHY, the easier the HOW. If the goal is just a “nice to have”, chances that you reach the goal become less.

Tip 3 Have the right attitude towards money

Your believes are thoughts you hold to be true. Your believes colour your reality and they are filters. These believes are not good or bad, but they can empower or disempower us. As long as they support your financial success, you should attach to them. If they limit your success, you should abandon or neutralize them. Find out what your believes about money are. Most of us have learned that money does not make happy….but what you can do when having money may…….Start to love money and want to have it. It will help you towards reaching other than financial goals.

Tip 4 Start to be willing to receive

“It is better to give than to receive”. This is NOT TRUE. We may have been taught this in your education, but if we teach people around us that we rather not receive, we will not be given anymore! And people who want to give should have the right to be happy about themselves as well; Do not hesitate to give and feel happy about it, but be grateful for what you receive and count your blessings.

Tip 5 Align Inner Game and Outer Game

Your Inner Game are your thoughts and feelings. Your Outer Game are your tools and your strategies. As soon as you start to align the two, you will see results and fast as well. Do not stay in a survival mode, come out of your comfort zone and play the game.

Tip 6 Deliver more value and you will receive more money

People pay money in exchange for value. The rule should therefore read, the more value you deliver, the more money you will receive. So start delivering bigger value and better quality to more people, more often and you will earn more money. Develop a strategy.

Tip 7 Create passive Income

There are two basic types of passive income. Money working for you and business passive income. The first one is money you already have that will create a return (interest, dividend, capital gain). The second one is investments such as royalties, licensing and real estate. Start creating both types of passive income even if it’s 50 cents per month.

Tip 8 Manage your Money

Spend at least 20 minutes a day on the management of your money. Manage the sources and the roots and allocate the fruits to different tasks. Do understand that if you are a business owner, you and your business are different entities. It is not the amount that counts, it is the system. Money Management plus passive income => financial freedom.

Tip 9 Simplify your life

Find out what you really need in life and what you could lose. Eliminate all the burden. If you are not reading that newspaper or magazine because you never have time, why not stop the subscription ? Get rid of the things that cost, but do not deliver. Sell the old toys in the attic, the clothes you do not wear anymore and the books you have read. Onload your burdens and free your mind and house of clutter.

Tip 10 Go for the Fruits not for the Roots

When you have some money, make it work for you. Make investments and get returns. Spend some time on a daily basis and concentrate on growing your assets. When that happens, only “eat the fruits” or reinvest them, but never touch the principal amount. Eat the golden eggs and not the goose.

In the next blog posts I will explain how I did some of these tips myself and what helped me to reach goals. Let me know which ones you would like to know more about and why and I will oblige.

Subscribe to this blogand automatically receive the next blog posts.

Esther Celosse

Follow-it

Very informative. I liked it.

Hi there,

Great that you subscribed. You will find more on this and other topics the coming weeks. Stay tuned…

Cheers, Esther

Hi Esther,

Super! The tips are very valuable!

Great stuff – thanks!

Hi Omayra,

More tips to come and all learned from great experts and “tested” by myself. I prefer to write about knowledge and tips that have worked for me and I have experience with. Everybody is different, so no guarantees of course, but if you have questions on how it could work for you, you can always contact me directly.

Cheers, Esther